Fatima Toor, an Analyst in the Lux Research Solar

Components Intelligence team, had conducted a webinar which focuses on the Opportunities that exist for Solar PV Equipment Manufacturers. Below are the key excerpts.

Fatima expalins that the 2012 global capacity

utilization is at 55% for crystalline silicon (x-Si) module production, 70% for

cadmium telluride (CdTe) and 80% for copper indium gallium (di) selenide

(CIGS). Under these market conditions there are almost no expected capacity

expansions in the near term. Though this is the case, the competition in the PV

industry to reduce costs and differentiation is gaining traction, which the Solar PV Equipment Manufacturers can tap.

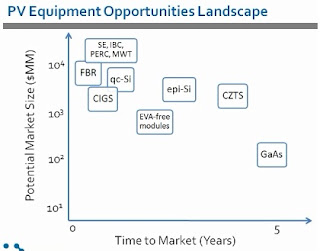

Opportunities for Solar PV equipment manufacturers in the current Turbulent Market

The Current fundamental drivers of PV industry are Cost, efficiency and price and the likes of cell and module manufacturers to reduce costs

and differentiate from other competitors will trigger opportunities for Solar PV equipment manufacturers across the Globe.

The Current Market conditions are driving innovations across C-Si value chain and this is introducing New Challenges to these Manufacturers.

Fluidized bed reactor (FBR) Process will gain Traction:

Qc-Si capacity set to increase:

The Opportunities are galore in the qc-Si ingot growth as Modified

directional solidification (DS) furnace makers claim 90 percent c-Si and

10 percent mc-Si yields during qc-Si ingot growth. In reality, 60

percent c-Si and 40 percent mc-Si results in high wafer binning and

sorting costs. This provides an opp for equipment manufacturers to

improve the c-Si yield to higher than 90 percent and as DS furnace manufacturers

are innovating there will be an uptick in Qc-Si Capacity.

Developemnt of thin film superstrate (TFSS) epitaxial silicon (epi-Si) solar cells:

Solexel and SunPower has started the development of thin film superstrate (TFSS) epitaxial silicon (epi-Si) solar cells which uses laser cutting based wafer release. Solexel has said that it had achieved a 20.6 percent cell efficiency utilizing a 156x156mm cell and Solexel are developing the Technology such that module costs can be driven down by $0.42/W. SunPower has also plans on developing a 1 GW Manufacturing Facility.

High efficiency Designs:

High efficiency cell designs are proving to be the next big thing that can provide opportunities for Solar PV Equipment Manufacturers. Canadian Solar is a tier 1 manufacturer of

crystalline Si wafers, cells and modules. Selective

emitter (SE) c-Si cells are likely to see an Uptick.

Process costs for CIGS will drop $0.10/W to $0.13/W between 2012-17 all thanks to process yields and better materials utilization. Also Copper zinc tin sulfide (CZTS ) is coming up as an alternative to CIGS and thus creating an Opportunity.

CdTe and GaAs technologies:

Though the CdTe/CdS module manufacturing is highly automated it still needs a good deal of Optimisation. Lux Research expects that by 2017, CdTe module manufacturing costs will reach $0.45/W. But Single-junction GaAs-based flexible PV modules will enable equipment opportunities in the long run.

Courtesy: Lux Research; Pradeep Chakraborty

For More Details Contact: rprabhu@renewindians.com

To Learn More about our services: Click here